Stock Market

Know This before Investing in the Stock Market

The stock market, also known as the share market or equity market, is a place where investors can buy and sell shares of publicly listed companies on an exchange.

SEBI [Securities and Exchange Board of India]: SEBI was established to regulate the securities market in India.

An investor can buy or sell stocks if they are listed on an exchange.

If you are looking for high returns in less time and are ready to take the risk, consider investing in the stock market. Unlike mutual funds, which take a long time to grow your money, the stock market offers the potential for quicker returns.

To start trading in the share or stock market, a person needs to have a demat account. A demat account is similar to a temporary bank account where the money is used during the buying or selling of stocks or shares.

Investments in the stock market are typically made through a stockbroker, who allows the investor to buy or sell shares of a company online while charging a commission, known as a brokerage fee.

It is mandatory to have a PAN card to open a demat account and start investing in the stock market.

After opening a trading account with the help of brokers like Zerodha, Sharekhan, Angel Trading, or other companies, the investor can begin investing in the share market. However, they must maintain a minimum amount in their demat account to trade.

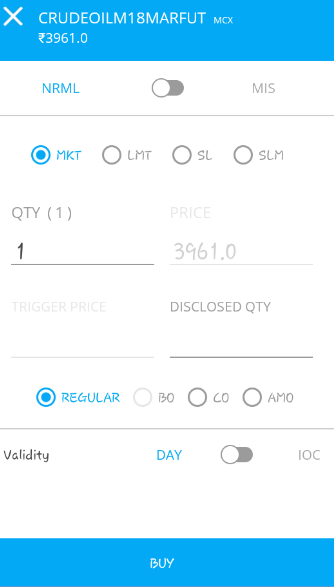

Example: If You Are Buying/Selling Shares in the Equity Market

- The investor needs to check for the company from which they can get a profit.

- Click on the same company.

- Choose the quantity they need to buy.

- Quantity [Total number of shares] = Total amount in demat account / CMP of the shares.

- Select SL [Stop Loss] and Target price.

- Select whether it’s for intraday or delivery/holding.

- Click on “Place Order”.

Invest will get the amount based on the market movement it can be profit or loss.

To calculate the profit/loss:

Profit/Loss= Total number of points * Number of shares for equity market shares.

Profit/Loss= Total number of points* Number of lots* Lot value.

Investing in the share market is like investing in the mutual fund but in the Share market, the risk is more with more profit based on investment and you can invest and earn the profit within a few minutes, hours etc.

Best Demat Account in India – List of Best Demat Account Online (Source: Top10stockbroker)

| Rank | Broker | Ratings |

| 1 | Zerodha | 8.60/10 |

| 2 | Angel Broking | 8.30/10 |

| 3 | Sharekhan | 8.18/10 |

| 4 | Edelweiss | 8.14/10 |

| 5 | 5Paisa | 8.04/10 |

| 6 | Kotak Securities | 7.96/10 |

| 7 | IIFL | 7.94/10 |

| 8 | Motilal Oswal | 7.84/10 |

| 9 | ICICI Direct | 7.80/10 |

| 10 | Karvy | 7.76/10 |

To watch the market movement use websites:

- Investing.com

- Mcx India

- Rediff money wiz

- NSE India

- Earnometer

- Moneycontrol

Also, Read at knowandask:

Agri market. NCDEX [National Commodity Derivative Exchange].